Let's zoom in on Applovin, a company that has carved out a niche for itself by specializing in mobile gaming—a bustling $90 billion market forecast to grow at 7% annually. Imagine a bustling city's gaming district, where every billboard and screen could present an opportunity for Applovin to display engaging ads that resonate with passersby.

How Applovin's Strategic Ad Placement Wins Big in the Programmatic Buying Arena and Beyond

In the adtech field, offering something genuinely noteworthy, something that stands out amidst the noise and clutter, can make a significant difference. It's about creating and distributing marketing content that captures attention and is worth talking about.

It's well known that industry giants like Google and Facebook are reaping substantial profits from it. Similarly, niche specialists like The Trade Desk have demonstrated impressive growth.

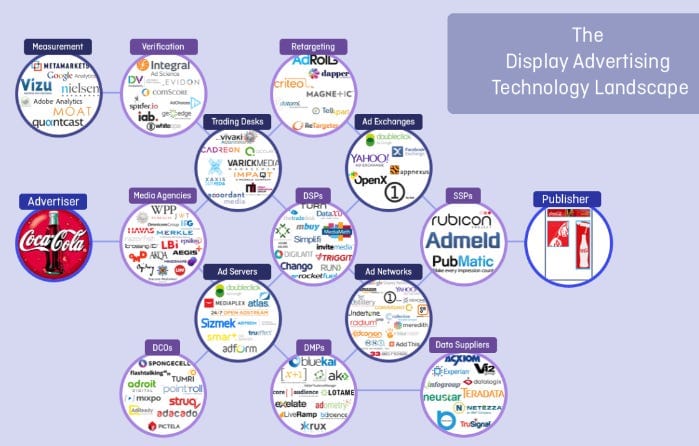

Simplifying the adtech model, we see it essentially connects advertisers with potential customers through digital advertising channels—for instance, a reader browsing articles in the Wall Street Journal or scrolling through Instagram. Traditionally, this connection was brokered by advertising agencies with established relationships with publishers like the WSJ. However, the internet's rise has largely shifted this paradigm towards programmatic buying.

Consider this scenario: a WSJ app user opens a news story. Instantly, the WSJ signals to the market that there is an ad space up for grabs. This ad inventory is pooled together on supply-side platforms (SSPs), which serve it up to ad exchanges, making it available for purchase. On the flip side, advertisers earmark their marketing budgets on demand-side platforms (DSPs), such as The Trade Desk, that eagerly bid on these ad spaces.

When we blend this approach with the sharp execution of adtech tools, we pave the way for marketing campaigns that not only reach their target audience but also resonate with them on a deeper level. It's about understanding the needs and desires of the people we serve and delivering precisely what they find remarkable.

By analyzing user interaction patterns, it becomes possible to forecast the likelihood of a user engaging with a particular ad, enhancing the efficiency of ad spend.

The adtech sector, presents a double-edged sword: challenging to master but rewarding for those who do. Companies can not only engage their desired audience but also encourage them to become vocal advocates—much like AppLovin, a candidate poised for growth as it navigates this intricate but lucrative domain.

At the heart of this digital bazaar are DSPs (Demand-Side Platforms) and SSPs (Supply-Side Platforms), which act as matchmakers connecting advertisers to the right audience. Much like how crowds are drawn to the most vibrant stalls at a market, ad networks like Google and Facebook draw advertisers and publishers by offering a more comprehensive, user-friendly experience.

This is where branding shines, creating the kind of advertising that's not just seen but talked about. The goal is to strike a chord with your audience, much like Coca Cola does, showcasing ads across various digital properties that catch the eye and induce conversations.

However, Apple’s ATT (App Tracking Transparency) policy has been like a sudden shift in the weather, forcing advertisers to adapt to a new climate.

It turned the tables on traditional data tracking, necessitating user permission before tracking could commence, akin to asking someone if you could follow them around the market to learn their shopping habits. In this changed market landscape, where consumers are more likely to opt out than in, the value of mobile ad data plummeted in 2022.

By using such strategies, the adtech industry can adapt to the new dynamics of user privacy, still delivering personalized advertising experiences without intruding on people's digital lives. With strategic planning and a remarkable offering, Applovin is set to continue its journey in the mobile gaming market, outpacing the challenges and harnessing the winds of change to sail towards further growth.

Adapting to privacy changes isn't new; it's part of the evolving landscape. Google's forthcoming shift away from cookies, for example, is expected to give way to an anonymous profile system. While this might sound like a whole new world, the underlying goal remains the same: ensuring ads reach the people most likely to find them relevant, much like a storekeeper tailoring display windows to the interests of passersby.

Steering through these changes requires agility, a quality that's been at the core of Applovin's strategy. The CEO's words on a recent call reflect this resilience: despite regulatory shifts or platform updates, the company has continually adapted, tweaking its core technology to stay ahead of the game. This mindset is crucial, echoing the philosophy of continuous improvement.

In the realm of mobile gaming, the revenue pie is sliced primarily into in-app purchases and advertising.

Applovin shines in the advertising slice, focusing on casual games where ad revenue is particularly ripe for harvesting. Even as Apple's privacy updates have made precision targeting trickier, affecting in-app purchases more acutely, Applovin's platforms have continued to thrive. This resilience is part of what makes the company's approach noteworthy

Applovin's robust software platform comprises two main modules dedicated to mobile gaming adtech. Max, the mediation software, connects game publishers to a range of ad networks and exchanges, ensuring ads are sold to the highest bidder, much like an auctioneer seeking the best price for a prized piece of art. The data harvested from these transactions is invaluable, offering insights into which gamers engage with ads—a key asset for their app discovery platform, powered by Axon AI.

Discovering new games can be like finding hidden treasures for gamers, and here's where Applovin's app discovery shines. It places ads for games within other games, using its trove of data to target potential players effectively. This process, akin to a matchmaking service, not only heightens user engagement but also drives Applovin's revenue.

Companies like Applovin are innovators in optimizing ad revenue for app publishers.

They have two primary services: Max, their ad mediation platform, and Axon, their app discovery business. Max operates on a traditional business model where Applovin retains a 20% cut of the revenue publishers earn from in-game ads. Axon, on the other hand, resembles more of a trading entity, where Applovin is compensated to deliver a specific volume of traffic or revenue to their clients and must procure sufficient ad inventory to fulfill these obligations.

Although Axon might raise some concerns about the quality of business, akin to perceptions around Criteo, Applovin might just turn this to their advantage. The rich data harvested from their ad mediation service might give them a significant edge, made even more potent with their considerable presence in the market. Adding to this, traditional advertising giants like Meta and Google face challenges in user tracking on Apple devices due to privacy updates. This limitation puts a dent in their longstanding advantage of visibility and historical data.

Furthermore, it's been noted by Applovin's CEO that a whopping 50% of gamers opt out of data sharing for personalized advertising, adding another layer of complexity to the advertising landscape.

With around 350 games from 11 studios, it's a decent-sized playground.

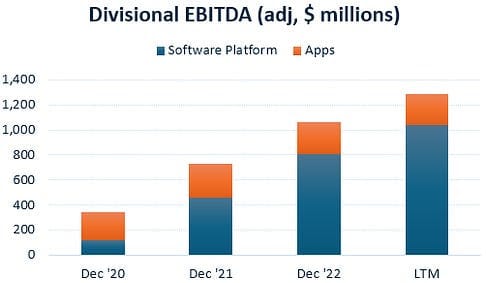

But here's where the plot thickens—a twist, if you will. Their software platforms have been maturing, growing like beanstalks, and in the process, the gaming corner of their empire has become just a small slice of the EBITDA pie.

Turns out, as their platforms expanded, they've become magnets for data from all over the gaming universe, not just their own backyard. The need to pump their own gaming data into the AI beast they've built? Not so much anymore.

So, what's a company to do? They hang a "For Sale" sign on the gaming biz, waiting for the right buyer to come along with an offer too tempting to refuse. If that doesn't happen, they've got a backup plan. Run the gaming business lean and mean, and let the cash flow back to the loyal shareholders.

Diving into the cutthroat world of mobile gaming, we see a player who's decided to shuffle the deck. They've been quietly downsizing their gaming segment, which makes sense for the investors. The real ace up their sleeve is their software platform, which towers over the fray with less competitive pressure. Think of it as the oasis in the mobile gaming desert.

As Applovin gazes over its domain, they can see IronSource on the horizon, freshly allied with Unity—a juggernaut in the game development engine arena. IronSource, though smaller, could hitch a ride on Unity's widespread clout to carve out a bigger slice of the pie. Yet, Applovin isn't sweating. They're betting on their own hand, piling chips on the stickiness of software and their data heavyweight status, thanks to their impressive scale.

The CEO laid the cards on the table at the JP Morgan conference. Spinning a tale of rapid growth, they've placed Max at the top of the publisher popularity charts. With heavy-hitters like MoPub, IronSource, and Google in the mix, Applovin made a power move by snagging MoPub and pooling the lion's share of inventory into one mega platform. Picture this: 700 million devices, daily, engaging with games monetized by Max. That's not just a large number; it's a colossus striding through the industry.

And what about that 66% market share? It doesn't just make sense; it's monumental. MoPub's acquisition wasn't just a win; it was a victory lap completed in a record-breaking 90 days. Moving the client base to Applovin's platform with such speed and finesse? That's not just business as usual. It's a testament to what can happen when the expertise runs through the company's veins, leaving a trail of remarkable feats in its wake.

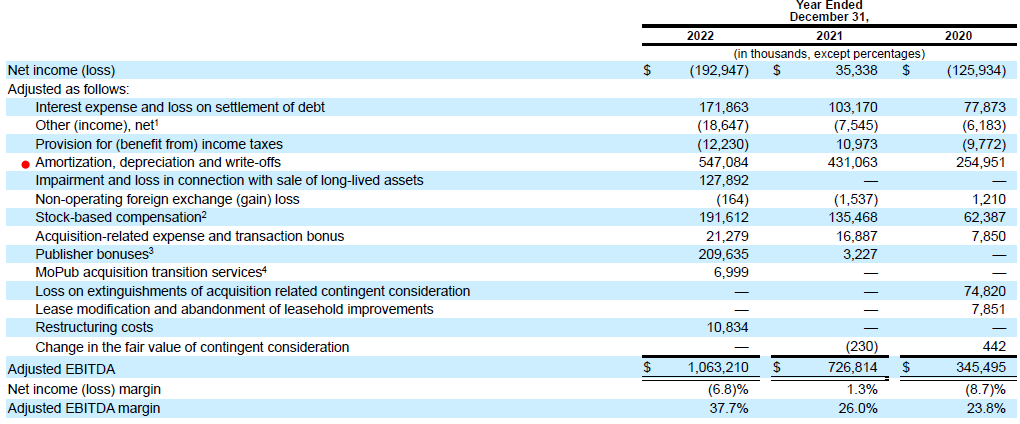

Now, for the juicy part—the numbers.

Applovin's growth stats are like a rocket, and that's no smoke and mirrors trick, even when you factor in the flashy MoPub acquisition early in '22. Fast forward to '23, and they're still firing on all cylinders (cue the impressive growth chart).

What's the real kicker? This tech isn't just sticking to the mobile scene; it's busting into connected TV territory – yeah, like your Netflix and Hulu world. It's an arena where even the big guns like Trade Desk are planting their flags. Applovin’s wager? That they can make a splash there too. And why not? When it comes to what they call "performance marketing" on the tube, it’s still pretty much the Wild West. If they pull it off, think of it as a hidden bonus track on an already killer album.

But hold up – it's not just about the telly. They're also slipping into non-gaming apps. That's broadening the horizon,. It’s like finding new roads on a map you thought you knew by heart. And while this slice of the pie might be thinner right now, they've got the recipe and the oven preheating to bake it bigger.

Now let's talk turkey. They're looking at bringing home $430 million in EBITDA just for the fourth quarter hoedown. If you do the math for the whole year, that's a cool $1.7 billion. And get this – the market's got them pegged at just 9 times EBITDA. That’s investor speak for "might be a bargain." The pencil pushers with their spreadsheets and forecasts? They might be selling the story short, scribbling down a modest $1.8 billion for EBITDA in '24. But whisperings and elbow nudges suggest that number could soar past $2 billion.

Conclusion

If Axon 2 and their other ventures play their cards right, we could be witnessing the emergence of a new heavyweight in the field of performance marketing. By pushing into the uncharted territories of connected TV and broadening their reach into non-gaming apps, they're not just chasing the next big thing; they're building a runway for it. And with a whiff of conservative estimates floating in the air, there's a sense that we might just be on the cusp of seeing those figures reach even greater heights.