This intrigue isn't a solo act. A recent dissection from Bank of America, with Jared Woodard at the helm, shares the spotlight. The narrative isn't just about numbers; it's about rhythm and repercussions. The Fed’s soft-pedaling on monetary policy might just be setting the stage for a repeat of the 1970s inflation saga. Our economic fabric, woven with threads of hefty federal deficits, burgeoning savings, and housing markets resilient as ever, appears to be shrugging off the Fed's interest rate hikes.

But the plot thickens. The year's aggressive rate increases have slowed inflation's sprint, yet the whispers of 2024 paint a picture of moderation, not eradication.

The devil's in the details, and the details are troubling. A persistent tightness grips the labor and commodity markets, and core CPI—running faster than historical norms—may be getting too comfortable at these perilous heights.

It begs the question: Could it be that only a deflationary chill can reset the economy's thermal gauge to its long-term average?

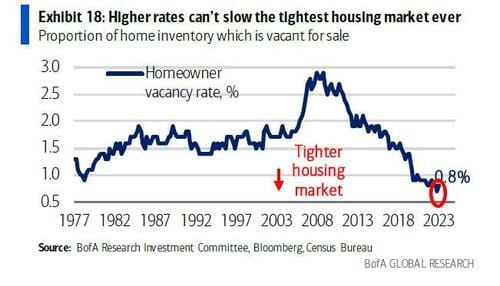

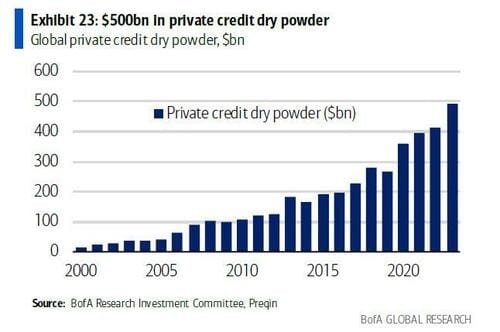

There's more. The housing market, shielded by fixed mortgage rates and a supply-chain stranglehold, seems unshaken. Corporate balance sheets, buoyed by private credit, are not just surviving the Fed's tactics—they're thriving.

Circling back to Uncle Sam, the government's fiscal levers seem disconnected from the Fed's dial. Unspent funds loom large, and deficits swell outside the bounds of recessions. Meanwhile, the silver-haired segment of our society enjoys inflation-adjusted benefits; these "wage" pressures are more than a passing breeze—they're the prevailing winds.

Bank of America seers foresee the U.S. deficit tapering relative to GDP, yet the specter of additional spending hovers, threatening to upend any semblance of fiscal restraint. And while the nation's economic engines are purring at high capacity, this roar may hinder the absorption of productive spending.

Diving into the household ledger, we find a fortress of financial stability. Savings are at historic highs, and property valuations stand tall in the face of climbing interest rates. Like their household counterparts, corporations are flexing financial muscles—with private credit as their backstop and cash flows that disdain traditional trends.

Our contemplation culminates in a stark realization: Inflation hedges are more pertinent than ever. A well-armored portfolio is the savvy investor’s standard against the uncertain tides of stagflationary pressures. As we cast our gaze upon government, household, and corporate sectors' robust expenditure, it becomes clear—they will be the ultimate litmus test for the Fed's inflation-wrangling prowess in 2024.

That’s it: A granular breakdown that paints a broader canvas of the Federal Reserve's strategic direction, the undercurrents of inflation, and the overarching economic equilibrium.