Rhapsody? The excitement is palpable into the new year, a feeling so intense it can only be described as euphoria. However, as Lester Burnham mused in "American Beauty," from this peak, the road ahead is all downhill.

But maybe not today, not this time.

By inference, the current market observations highlighted by Goldman Sachs trader Cullen Morgan: the S&P has experienced a remarkable nine-week ascending streak, which is a rare occurrence.

This shift in both sentiment and market stance has marked a drastic change in the landscape of U.S. equities.

Whether the times are bullish or bearish, the market is at a turning point, and informed decision-making becomes paramount.

U.S. futures are currently peaking, almost reaching unprecedented levels.

History has shown us that when non-dealer positions exceed $130 billion, the market typically enjoys robust short-term gains, but the outlook from three months to a year becomes less certain, often trending negatively.

With positions currently valued at over $158 billion, there's a heightened sense of caution amongst informed traders who are keenly aware of the potential challenges this may pose.

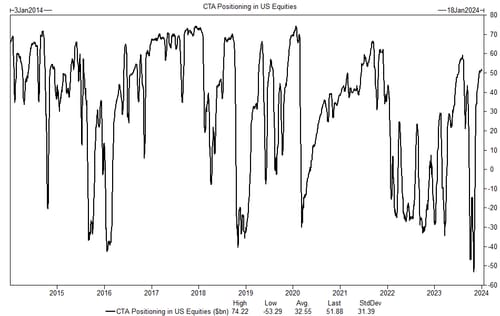

Currently, we're seeing CTA positioning in US Equities edging towards the peak levels of 2023.

While the actions of this group are generally moderate—tending to buy modestly in stable or rising markets and to sell lightly in falling ones—their behavior isn't ignorable, especially near crucial pivots.

It's worth underlining these specific thresholds: a short-term level at 4618, a medium-term boundary at 4481, and a long-term one at 4420.

Although all are vital in their own right, the latter two deserve extra vigilance.

They are the tipping points that could signify a larger wave of selling by this sector if crossed.

Stock market is a bustling city, and these thresholds are traffic lights.

When the market is above 4618, it's like a green light—traders are cruising confidently.

But as we approach 4481 and 4420, it's akin to the lights turning yellow and red, indicating caution and a potential stop as traders may shift to sell more aggressively.

Remember, pay close attention in observing these key levels to capitalize on them potentially.

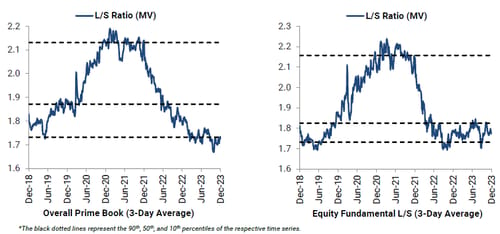

As you consider your investment, it's worth paying close attention to the current behaviors of hedge funds, specifically in terms of their leverage and long/short positions.

The narrative hasn't shifted dramatically since the last quarter, but the details tell us there's a pronounced stretch in how hedge funds are leveraging their investments — they're playing a high-stakes game with the capital they have at their disposal.

Prime Book reflects a gross leverage that's now at 260.3%, perched firmly in the 96th percentile over a three-year range.

This suggests that hedge funds are borrowing heavily relative to their equity — they're pushing the envelope on risk to amplify potential returns.

Net leverage is at 67.5%, significantly lower than gross, meaning the actual exposure, after accounting for shorts, is less extreme but still significant, sitting in the 24th percentile of the past three years.

In simpler terms, imagine hedge funds as tightrope walkers.

They're balancing not just their weight but also the weight of additional heavy backpacks (gross leverage), which could either help them (1) perform thrilling feats or (2) dramatically increase the risk of a fall. The net shows they have some counterweights to help, but the load is still heavy.

Moreover, the Long/Short (L/S) ratio, which paints a picture of the market value balance between their long (bought) and short (sold) positions, has seen a slight increase.

Sitting at a long/short ratio of 1.7, we're looking at a very unbalanced posture favoring long positions, which are at the lowest end of the spectrum in comparison to the past three years.

This implies a bullish tilt among hedge funds — they're betting more on the growth of their investments than on potential declines.

Global Fundamental Long/Short strategies also show a marked increase in gross leverage, at 190.3%, placing them in the 97th percentile.

Yet, their net leverage remains more moderate, and the L/S ratio has decreased slightly, indicating a slight shift towards more balance between long and short positions, but still with a general lean towards the 'long' side.

What does this mean for you?

It's a bit like standing at a busy intersection and trying to predict the traffic flow.

You can see the hedge funds charging ahead full throttle with their high gross leverage, yet their net positioning tells us they have some hedges in place.

With the L/S ratios indicating a strong preference for long positions, it feels like most are betting on the light staying green.

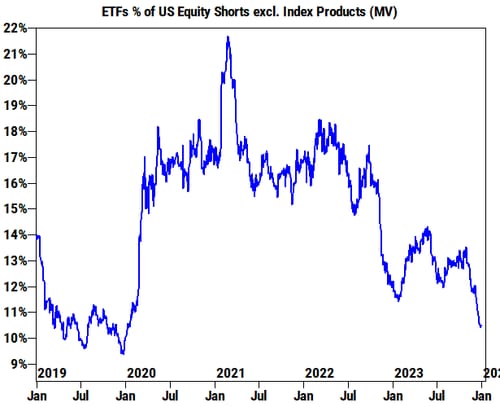

Time to unpack the short selling, which can be like the undercurrents that sway the market's surface. A noteworthy trend is emerging in the realm of macro products, particularly Index and ETF shorts. There's been significant tidying up, culminating in ETF shorts now accounting for just 10.5% of the US equity short book, excluding Index products. This is the slimmest slice we've seen since January 2020, placing it in the lowermost 9th percentile when we look back over five years.

To translate, consider short selling akin to someone betting on a dip in the stock market. The current situation shows a clear trend of investors stepping back from such bets within ETFs, which are baskets of stocks traded on the market, much like individual stocks. This retreat from short selling is like a community deciding to take down the 'for sale' signs from their yards, signaling a shift in the neighborhood's outlook.

What's truly interesting is this downshift from the 11.9% at November's close and the 12.0% level as the year kicked off. It suggests a rapid change of heart among investors, or perhaps a more strategic maneuver in anticipation of market shifts.

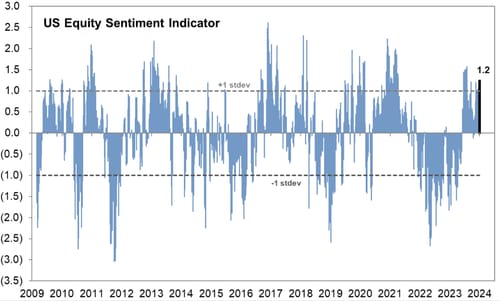

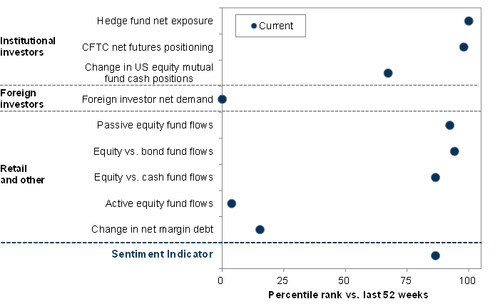

Goldman Sentiment Indicator

Let's simplify and shine a light on a key sentiment gauge in the stock market—one that reflects the collective pulse of institutional, retail, and foreign investors, who together hold sway over more than 80% of the US equity market. It's called the Goldman Sentiment Indicator, and right now, it's stretched to +1.2 standard deviations. This stretching isn't just a random blip, it's a signpost pointing to heightened eagerness or anxiety among investors.

Think of it as a rubber band.

When it's at rest, investor sentiment is neutral. But when it's stretched, like it is now at +1.2 standard deviations, it indicates that investors are potentially overextended in their bullish or bearish stances. This meter of market mood is crucial because it can both reflect and influence investment decisions, acting as a barometer for market trends.

Why does this matter to you?

It's a signal which means that the market is ripe for a course correction, a change in the wind you might need to prepare for.

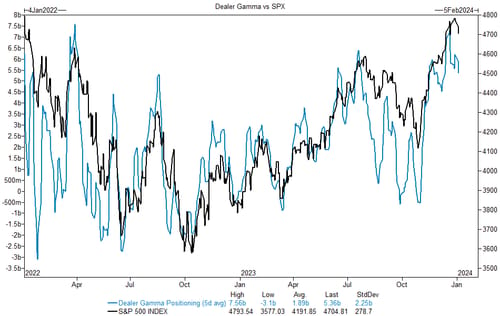

S&P Dealer Gamma Positioning

For the S&P index, this metric has seen a significant decrease from its record peak in early December.

In essence, gamma positioning gives us insight into how certain options traders, specifically dealers, are positioned and how this might affect the stock market.

Imagine gamma like the springs under a car;

When they're tight, every bump might be felt more sharply, influencing the car's stability.

When dealer gamma positioning is high, stock prices can react more violently to market moves.

The 'record peak' was like a tightly coiled spring, potentially leading to greater market volatility.

Now, as this tension unwinds, it can indicate a less reactive market ahead.

This change is significant because it can be a precursor to calmer waters or, conversely, signal a different kind of instability as we diverge from previous patterns.

If market volatility has been a source of concern, the release of dealer gamma could be the assurance you've been seeking. Or, if you're the type that sees opportunity in the waves, this could be your call to surf.

Let's bring it down to earth.

Right now, dealers are long $4 billion of gamma. Think of gamma as the sensitivity of an option's price to changes in the stock price. When dealers are 'long gamma', they have positions that gain value as the market becomes more volatile.

Currently, the expectation is that this long gamma position will shift—moving away from 'downside strikes' (bets on market drops) to 'topside strikes' (bets on market rises) by next week.

What does this mean for you?

We might see a softening of upward market moves and a sharper reaction to any downturns. This shift in gamma could represent a moment to reassess your positions, whether to brace for potential jolts or to prepare for more subdued growth. Understanding these under-the-hood mechanics can be your edge, guiding you towards more informed and, hopefully, more profitable investment choices.

Let's talk about the market's temperature gauge—the GS US panic index.

This isn't about fearmongering but about gauging the market's collective heartbeat.

At present, this index, which uses a two-year rolling percentile of four key volatility metrics, is registering pretty calmly.

What's more, it suggests that investors are not hitting the panic button yet, despite the array of uncertainties that often cloud our economic skies.

The panic index is a cocktail of critical ingredients:

We've got the S&P 500's standard level of fluctuation (implied volatility)

The expected volatility priced into market hedges (VIX call implied volatility)

The comparison of demand for protection from market drops versus surges (volatility skew), and the market's short-term versus medium-term expectations (term structure).

Together, these metrics show us the market's stress levels—and right now, they're indicating a steady pulse rather than a frenzied beat.